A 30-Minute Interactive Lesson from Prof. Robert Simons

Identifying Competitive Risk

Introduction

Detecting Change in the Competitive Environment

Identify a business that, like Blackberry, failed due to a significant change in its competitive environment. What was the change? How did it impact the business?

Peer responses

" "

Blockbuster. Moving the ability to watch movies on demand eliminated the use for VCR and DVD rentals. Blockbuster went out of business.

Nancy R, United States

" "

TiVo, they had great technology but no ability to help customers understand why they should care about the technology.

Kristen P, United States

" "

Tower Records. Napster introduced music downloads and Apple introduced online buying and streaming. Tower records did not switch to digital music format they ended up closing their brick and mortar business.

Sandi D, United States

" "

Blockbuster and the dvd movie rental business failed with the introduction of streaming services like Netflix. Technology evolved and made dvds obsolete. The technology put Blockbuster out of business entirely.

Stevie G, United States

" "

Hummer is an example of a business that failed to respond to changes in the competitive environment. Despite increasing emphasis on eco-friendly cars and improving gas mileage, Hummer continued to make very large, fuel inefficient vehicles. This ultimately led to its demise as demand for such vehicles dried up.

Alex F, United States

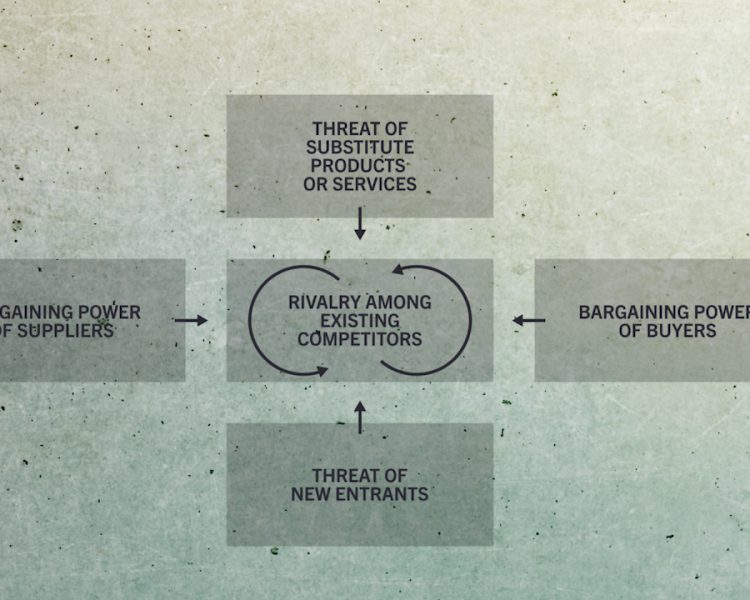

Taking all five forces into account, what competitive risks come to mind when you consider your own business?

These might be risks that your business has already worked to address or is working to address (or that it failed to address in sufficient time), or they might be risks that have emerged more recently.

Consider the change that each force can bring to the competitive environment:

- Demanding customers may choose to switch suppliers

- Substitute products or services may become available with lower costs or superior attributes

- Suppliers may choose to limit availability or increase the cost of critical inputs

- New competitors may enter the industry with new technologies and products

- Intense rivalry from existing competitors can erode profit margins

For each force, list the potential and/or current risks in your organization:

Peer responses

" "

1. Private equity groups are very demanding and if you do not meet their needs re lower pricing or structural flexibility, they will switch lenders.

2. Other banks and non-banks have become extremely competitive on pricing and structure while offering the same capital.

3. This is not a concern that is relevant to my business.

4. Many new competitors have come into the market over the last several years which has significantly increased the competitive market dynamics.

5. We have been forced to cut pricing on our deals in order to win them vs our competition thereby impacting our profitability.

Alex F, United States

" "

1. Always a risk, but we have tried and true processes for serving demanding customers, profitably

2. We see very large companies entering our market, forcing my company to re-evaluate how we can maintain our place in the market.

3. N/a

4. If a new competitor enters with technology that can do the same as our technology - at a lower cost or new benefits, we are at risk!

5. We have a rivalry with one organization—however, we serve slightly different customers. The risk is that some customers in the market don't see the difference in what our products offer.

Stevie G, United States

" "

1. Customers can easily switch to competitors offering broader online products and services portfolios.

2. Yes. Online versus physical products.

3. Yes, there is a dependency on 3rd party product components manufacturers.

4. Less likely given barriers to entry.

5. Highly competitive environment with established brands who have the flexibility to change price points to their advantage.

Sandi D, United States

" "

1. This is a huge risk, we are a commodity and our competitors gain is our loss. We do not want to lose market share.

2. Same as 1!

3. Huge risk, this will affect what we can sell our products at and for some customers, the differentiator is cost.

4. Another big risk for us, being a commodity.

5. This applies as well... under threat from all sides it seems.

Kristen P, United States

" "

1. Low risk here. We are the leader in our service field. Further, we are the only provider with training tools in our region. There are other competing orgs nationwide, but there is more demand than serving organizations.

2. Somewhat high. I have a close eye on a competitor that is a master at marketing themselves.

3. N/a.

4. Very unlikely that a new competitor could reach our level of experience, which was accumulated over decades.

5. Very low. The demand is higher than supply and I don't see that changing.

Nancy R, United States

The Need for Speed: Meeting the Demands of Online Shoppers

Now that you have reflected on some of the competitive risks faced by your business, let’s turn our attention to a case that will give you an opportunity to examine the ways in which competitive risk can impact strategy. This case features Bruce Welty’s business, Quiet Logistics.

Here, Bruce reflects on the shipping and pricing challenges posed by changing consumer expectations as the popularity of e-commerce grows.

Note: This online case is based on the case developed by Robert Simons and Natalie Kindred (HBS Case No. 115-001).

Quiet Logistics responded to customer demand for speedy delivery by using a robot system supplied by Kiva Systems (a startup company located nearby). Kiva robots brought shelves of inventory directly to warehouse employees who were stationed at the periphery of the warehouse. Those employees—whose job was to prepare outbound packages—could then select the requested piece of inventory without having to walk into the warehouse to retrieve it.

Quiet Logistics was one of the first fulfillment businesses to use Kiva robots, and Bruce believed it gave them a distinct advantage at a time when many competitors relied on less efficient and more error-prone human labor.

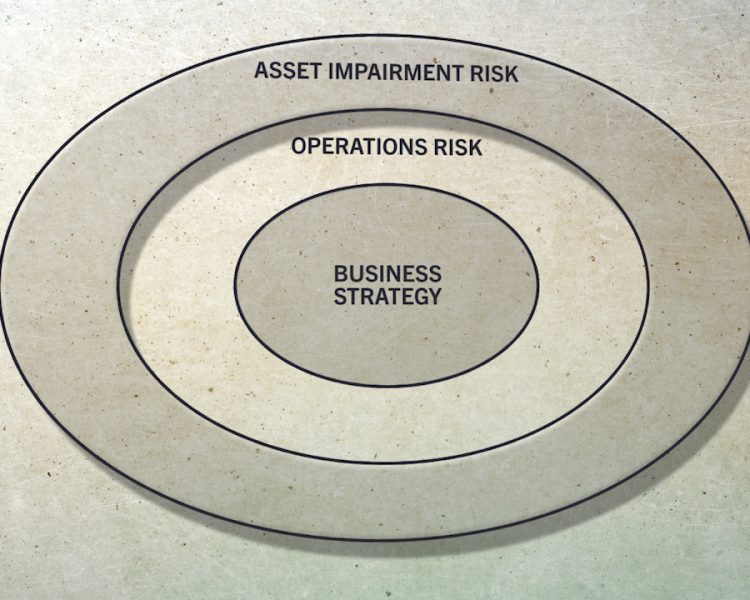

Considering what we have studied so far about competitive risk, what concerns do you have, if any, about Quiet Logistics’ decision to use Kiva Systems robots as a key part of their internal fulfillment operation?

Peer responses

" "

Process dependent on 3rd party robotic systems (repairs, service support). Kiva going under could have catastrophic consequences on business model. Competitors can also acquire the same technology.

Sandi D, United States

" "

The robots pose an operational risk as any failure by the robots to properly conduct their jobs could significantly impact fulfillment.

Alex F, United States

" "

Asset impairment risks. If the robots are the solve for customer expectations, what if something happened to the robots - they malfunction, breakdown, something happens to the factory they are stored in, etc.

Stevie G, United States

" "

I would be concerned about security vulnerabilities in the robot, I'd also be concerned that the robot is monitored for errors, anomalies. I'd also consider the robot's resilience to be a risk.

Kristen P, United States

" "

Operation Risk - Making certain the correct item is always selected and QCd by the warehouse worker. It can get really easy to rely on the machine. Asset Impairment - Becoming so reliant on the machine, that if it goes down, one cant quickly rebound to keep up with demand. Competitive Risk, another company using QL as a benchmark and deciding to improve their operations with better machinery.

Nancy R, United States

You might have said that building a competitive advantage on a supplier relationship could be risky. However, Bruce knew the founders of Kiva well and remained confident in his decision to use their system as a key differentiator for his company.

Place yourself in Bruce Welty’s shoes. Your greatest competitive advantage is on the line. What is the first action you would take on behalf of Quiet Logistics in response to this news?

Peer responses

" "

My first reaction would be to call Amazon and see if you can work with them, then I would take steps to see about another solution because eventually, your cost will go up if you don't either figure out how to manage this yourself or negotiate a good contract with Amazon.

Kristen P, United States

" "

I would definitely call a meeting with company employees to explain what is happening. I would also contact Amazon to immediately find out more information and assess the impact on QL.

Nancy R, United States

" "

My first response would be to contact Amazon and ask them if they are going to license out Kiva or discontinue its external use. If the answer was the latter, I would begin the process of securing a new vendor.

Alex F, United States

" "

Engage with Amazon to understand implications and future support models while looking for a alternative business strategy.

Sandi D, United States

" "

I would evaluate other robot options to make sure they can maintain business as usual. I would also schedule time with Amazon to see if their vision for the Kiva robots aligns with mine.

Stevie G, United States

In a recent survey of HBS Online learners, 42 percent said they earned an average $17,000 salary increase after completing a course—that’s a 10-times return on investment.

Achieve what’s next. Earn a certificate from HBS Online.